Hims and Hers - Impact of the discontinuation of the sale of Wegovy/Ozempic (Novo Nordisk) - ENG

Summary and Potential Impact of the Contract Termination with Novo Nordisk

Background

Commercialization of GLP-1 by Hims & Hers

In May 2024, Hims & Hers began offering compounded versions of semaglutide (GLP-1), under an FDA approved exemption due to a declared shortage. This generic version was sold at a significantly more competitive price than the original.

This lower price, combined with extremely high demand, made the drug the company's flagship product. However, in February 2025, the FDA declared the shortage resolved and limited its commercialization, granting a grace period until May 2025.

In April 2025, Hims reached an agreement with Novo Nordisk to distribute the original drug Wegovy/Ozempic.

Contract Termination

Despite having signed the agreement and the expiration of the authorization to sell the generic in May 2025, Hims continued to market it, relying on a legal loophole in the regulation.

While this did not technically violate the law, the Danish pharmaceutical considered the move misleading and unfair, and decided to terminate the commercialization agreement on June 23.

Impact

The termination of the agreement caused the company's stock to drop by nearly 34% yesterday. This reflects the company’s significant reliance on sales of the weight loss drug.

In Q1 2025, the company reported a year-over-year growth of 115%, of which 85% was attributable to GLP-1 sales. The rest of the business grew by 30%.

Impact Modeling

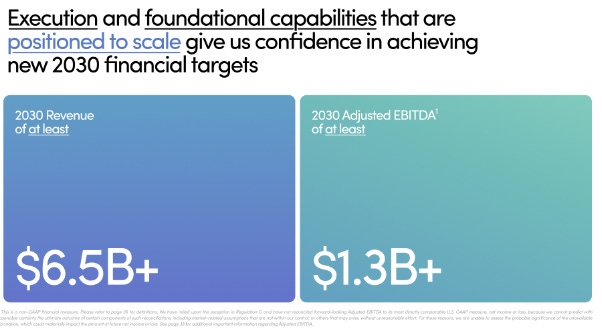

For the modeling, it has been assumed that the company will maintain the same growth rate reported in 2025 through 2030, and that it will achieve an EBITDA margin of 20% by 2030 (compared to a 12% margin in 1Q25).

With these assumptions, the Company would be trading at an EV/EBITDA multiple of 11.2x by December 2030. It is important to note that a 20% margin has been used, as this is the target stated in the Company’s 2030 guidance.

The calculated projection would align with the forecast presented by the Company in its May 2025 presentation.

Conclusion

First of all, I am surprised that the company has carried out such a risky operation to obtain margin in the short term, risking the potential sale of one of the most popular drugs in the world related to weight loss, in one of the most obese countries in the world.

Although it is true that it is always possible to re-sign the contract and that it could have been a temporary pressure measure on the part of the pharmaceutical company. I see this scenario as a long shot based on the type of comments made by Novo Nordisk.

The company should provide another guidance as soon as possible to be able to estimate how much of the expected growth was for Wegovy/Ozempic.

Although it is possible that the company has been conservative in its inclusion, since, in the model, projecting the same growth as that generated by the rest of the drugs in 1Q25, it would more or less reach the Guidance.

However, this would mean maintaining the 30% sales growth rate and increasing the EBITDA margin by 9 percentage points, from the current 12% to 20%.

Unlike other analyses I have published, this one has been completely superficial, as I have not conducted an in-depth analysis of the company's competitive advantage, whether growth could be lower or higher, or whether the expected multiple for 2030 is expensive or cheap.

However, it can be stated that the multiple is demanding, and the company offers a limited margin of safety at the current valuation, and even more so in an unfavorable macroeconomic environment.

In a context where the average consumer is significantly tightening spending, a company offering complementary drugs on a subscription model, and therefore considered discretionary by consumers, may face considerable pressure.

This is particularly relevant given the recent reports from other discretionary consumer companies.

This is neither a buy recommendation, nor a sell recommendation, but simply a subjective analysis based on the information provided by the Company.